-

Latin America and the Caribbean’s critical mineral resources are needed for the global energy transition. Developing the LAC mining and processing sector can also help diversify strategic supply chains for the US and Europe and boost domestic economic development within the region.

-

However, the only way that these resources can effectively be exploited is if done in a socially and environmentally sustainably manner. Without that, mining activities can have a significant negative environmental and social impact, especially for indigenous communities as evidenced by LAC's lowest performance relative to other regions concerning ESG-impact allegations linked to the mining of critical minerals.

-

Industry regulators and local and national governments need to be included to ensure adherence to ESG standards. Authorities need to enforce these standards through the entire critical minerals value chain, even for Chinese companies that don't adhere to international regulatory standards. This would improve the sustainability of the mining sector and could help boost Western competitiveness in the region.

-

Most importantly, local populations, especially indigenous peoples, need to be consulted from the beginning. To build trust and obtain a ‘social licence to operate’, authorities can't just ensure compliance with ESG standards, but they should engage with local communities by setting up a dialogue between stakeholders, investors and communities.

The global energy transition is transforming the world economy and risk environment. The resources needed to fuel growth are changing and so are the places these resources come from. Businesses and governments in North America and Europe are seeking to diversify and improve the resilience of their supply chains for these critical minerals and Latin America and the Caribbean (LAC) is a central consideration. The LAC region holds significant shares of the world’s critical minerals with great, long-term potential to contribute to the global energy transition. But the key to unlocking this potential is to ensure sustainability.

LAC faces major structural weaknesses like a challenging business environment, high socioeconomic inequality and limited integration in global supply chains. These weigh on the region’s growth potential and attractiveness for investment. As we previously flagged, the global need for a mining boom of critical minerals to meet the climate goals could be a turning point towards bringing more domestic value added. In this report we dive deeper in the state of play of critical minerals in LAC, the challenges and what needs to be done to open opportunities.

Resource-rich Latin America plays a critical role

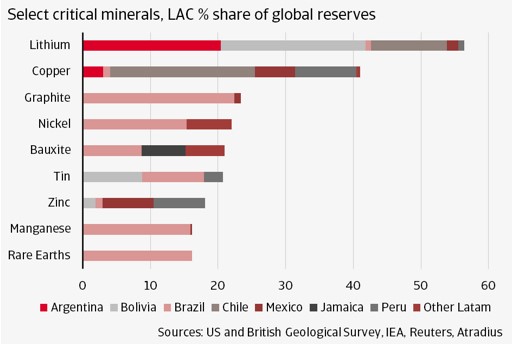

The mining boom, required for meeting the global climate goals, offers opportunities for the resource-rich countries in Latin America and the Caribbean (LAC). More than half of the world’s reserves in lithium are located in the LAC region, mostly in Argentina, Bolivia and Chile, the so-called Lithium Triangle. Additionally, the region holds some 40% of the world’s copper reserves, mainly in Chile, Peru and Mexico, but also in Brazil, Panama, Colombia, Ecuador and Dominican Republic, the largest mineral producer in the Caribbean. And finally, with shares in the world’s reserves between 16% and 23%, the LAC region has significant potential to supply some other essential minerals such as bauxite, the primary source of aluminium that is increasingly being used in electricity networks, graphite, nickel, tin, manganese and zinc, and rare earth elements.

Brazil has by far the largest reserves of these minerals in LAC. However, it currently produces only small to moderate amounts of them. The exception is bauxite: Brazil is a leading producer and recycler of aluminium. Argentina also has significant lithium reserves and is beginning with production. Bolivia, Chile, Mexico and Peru are already well-known mining countries. Next to these countries, also Jamaica (bauxite), Dominican Republic (bauxite and nickel) and Guatemala (nickel) produce these minerals. These countries have well-established mining sectors and infrastructure (with the exception of Bolivia) which they can further develop to meet the growing demand for minerals to achieve the climate goals.

1 LAC holds large share of global CM reserves

The global importance of LAC is already evident in its high share of investment in exploration for critical minerals. About one-third of global investment is directed to LAC countries, with the majority linked so far to copper. Over the past decade, investments in the exploration of copper in LAC rose from around 30% of global investment in 2012 to nearly 45% in 2022. In 2019 Panama, for instance, started producing copper in one of the largest copper mines to be opened in the past decade. Lithium saw its share of global investment double over the same period. Notable developments in lithium include the opening of a mine in Brazil in 2023, in Argentina a large mine is expected to start operating in 2027, a consortium of Chinese companies end-2022 launched a pilot project in Bolivia for the mining of lithium and Brazilian state-owned oil company, Petrobras, in 2023 expressed interest in investing in Bolivia’s lithium.

But will critical minerals offer a new earnings model?

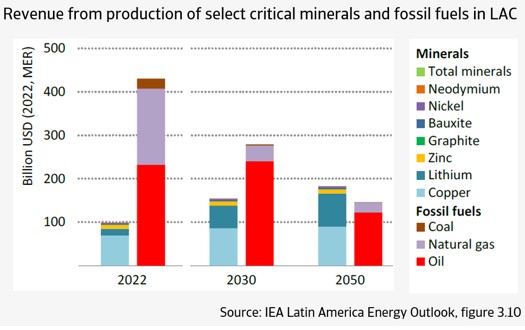

Developing these vast mineral resources will give a boost to the economies of LAC. Our baseline expectation, adopted from the IEA’s Latin America Energy Outlook 2023, is that LAC revenues from the production of the selected critical minerals will increase about 50% by 2030 and a further 33% by 2050, bringing revenue from critical minerals to some USD 200 billion, almost double its 2022 level. The IEA estimates that these revenues would have to increase by almost 2.5-times compared to 2022 in order to reach the global net zero by 2050 targets. Nearly all of the revenue growth is generated from lithium.

Remarkably, by 2050, the LAC revenue from critical minerals will overtake the combined revenue from the region’s – by that time much lower - fossil fuel production. It however remains to be seen whether the production of critical minerals offers a new earnings model for the region. The combined revenues from the production of the selected critical minerals and fossil fuels are estimated by the IEA at about USD 330 billion in 2050. This is significantly lower than the USD 520 billion earned in 2022.

This expected loss in overall revenues might explain the fast expansion of fossil fuel exploration and production in some LAC countries. Brazil, LAC’s largest oil producer, joined the top 10 of global oil producers after an increase of its production by almost 50% between 2013 and 2022 and aims to become the world’s fourth largest oil producer by 2029 (from 9th in 2022). Oil discoveries in bordering Guyana since 2015 have turned this tiny country into a leading oil producer that is on course to enter the top-20 of global oil producers by 2026. And Argentina’s new president, Milei, recently proposed market-friendly reforms to attract more investments to further develop its vast shale oil (world’s fourth largest) and shale gas (second largest) reserves and expand oil and gas production. Argentina sees this as a key industry next to mining, and an important source of foreign currency earnings.

2 Revenues from CMs to surpass fossil fuels by 2050 in LAC

Further, the sale and export of these critical minerals in and of itself does not translate into economic development, as we examined in our last report, How to unlock Latin America's potential for nearshoring. The composition of LAC’s exports of merchandise goods has worsened dramatically over the past two decades. The share of lower value-added commodity trade rose, as resource rich LAC, and particularly South America, provided the raw materials for China’s transformation into the world’s manufacturer. To lift the earnings potential of their mining sector, resource-rich LAC countries are looking for ways to add more value domestically by encouraging building local processing, refining, and manufacturing facilities associated with mining.

LAC mining boom is in the world's strategic interests

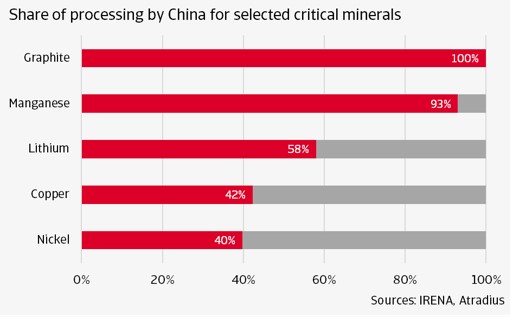

A mining boom could contribute to economic development in LAC while also boosting the security and diversification of critical mineral supply chains – a major strategic interest for the US and Europe who seek to reduce their dependence on China for critical mineral processing activities. China accounts for (nearly) all of global refining capacity of critical minerals like graphite and manganese as can be seen in figure 3. It is also the world’s largest processor of lithium and copper, the mining of which is dominated by LAC.

3 China dominates the global refining of critical minerals

Policymakers in the US and the EU have already introduced policies that should help stimulate investment in LAC for this reason. The US introduced the landmark Inflation Reduction Act (IRA) in 2022 which aims in part at investing in domestic energy production and promoting clean energy. One provision of the IRA is that by 2027, 80% of the critical minerals and battery components for electric vehicles must be extracted or processed in the US or a country with a free-trade agreement (FTA) with the US. Chile, Colombia, Mexico and Peru have FTAs with the US. So do Panama, the Dominican Republic and Costa Rica among other emerging Central American countries. Another example is the Memorandum of Understanding signed in July 2023 between Chile and the EU to establish a strategic partnership on sustainable value chains of raw materials between the two partners. A key aspect of this partnership is to create added value in Chile.

Partially in response to higher Western investments in the region’s mining sector, China is shifting more of its regional investments towards critical minerals. The world’s largest producer of electric vehicles (EV), Chinese BYD, is investing in a lithium cathode plant in Chile. And in July 2023, BYD also announced plans to make Brazil its first EV and lithium iron phosphate battery manufacturing hub outside Asia. Earlier this month, BYD announced plans to set up a new EV factory in Mexico that would serve as an export hub to the US market. Higher Chinese competition in the region also complicates the West’s goal of reducing dependence on China.

Domestic governments are also increasingly active in developing LAC’s mining sector. Argentina’s state-owned company Y-TEC opened the first lithium battery factory in Latin America in the end of 2023. Another plant is scheduled to open in 2024. Moreover, mining company Southern Copper, a majority-owned, indirect subsidiary of Grupo México, is considering investing in copper smelter projects in Mexico and Peru to reduce dependence on offshore smelters, including in China. These are promising examples of creating more value locally from mining, but governments have also pursued some resource nationalisation policies, which might scare off private investors. Mexico for instance nationalised its lithium industry in 2022 and Chile’s government in 2023 proposed major reforms to increase the role of the state in lithium projects, including creating a national mining company and the requirement that all future lithium projects become public-private partnerships.

Still, the process of attracting investment and developing local value-added from the mining sector will be challenging due to ongoing policy uncertainty, limited access to technology and skills, increased anti-mining protests and social unrest in an increasing number of countries. Unpredictable policies including resource nationalisation will make investors hesitant to start new mining projects and invest in midstream and downstream operations. But overall, probably an even more important bottleneck might be expanding mining activities itself.

Mining sustainably needs to be prioritised

The challenge for the mineral-rich LAC countries will be to expand their mining activities in a sustainable way. Mining has been associated with a host of negative environmental, social and governance (ESG) impacts, including environmental contamination, deforestation, human rights violation, and corruption. Mining is highly energy- and water-intensive, deploys the use of heavy machinery, produces significant waste, and often leaves open pits behind in the landscape. It’s also vulnerable to natural disasters. Mining is also dangerous for mine workers, particularly in the case of underground mining, and is associated with child labour.

The IEA’s Latin America Energy Outlook shows Latin America scores the worst among all regions on ESG-impact allegations linked to mining of critical minerals. It had in the period 2010-2022 the highest number of publicly reported environmental and human rights abuses at mine sites. Allegations were particularly high in the impact on communities and the environment (about two thirds of the allegations reported world-wide). This is because minerals in Latin America are often located near sensitive nature reserves, many of which are home to indigenous people.

The negative environmental and social impact of mining activities causes community protests almost everywhere that mining companies are active. But this is particularly true for the LAC region. According to the Global Atlas of Environmental Justice, a worldwide database on mining conflicts, 45% of reported conflicts are located in Latin America. Major disasters during the last decade have fed anti-mining sentiment. Heavy rainfall in 2014 in Mexico for instance resulted in the spill of 40 million litres of copper sulphate into the Sonora River in Mexico, making it the most serious environmental disaster in the history of mining in Mexico. Two tailings dam collapses occurred in Brazil in The negative environmental and social impact of mining activities causes community protests almost everywhere that mining companies are active. But this is particularly true for the LAC region. According to the Global Atlas of Environmental Justice, a worldwide database on mining conflicts, 45% of reported conflicts are located in Latin America. Major disasters during the last decade have fed anti-mining sentiment. Heavy rainfall in 2014 in Mexico for instance resulted in the spill of 40 million litres of copper sulphate into the Sonora River in Mexico, making it the most serious environmental disaster in the history of mining in Mexico. Two tailings dam collapses occurred in Brazil in 2015 and 2019, causing gigantic mudslides that destroyed villages and infrastructure. The first occurred on the Doce river, killing 19 people and the second on the Paraopeba river, killing 270.

These mining-related conflicts come in many ways, but particularly take the form of social protests and strikes, which often come along with road blockades. Increasingly, indigenous people protest against the opening of new mines, as they directly feel the impact of mining on their environment and access to clean water and land, while usually benefitting the least from the revenues generated by mining. A recent example is Peru, where anti-mining protesters demanded the president to deliver on her campaign promise of cancelling the Tia Maria greenfield copper mine project, so far with little success. This is in contrast to Panama, where massive protests eventually forced copper mining operator First Quantum to suspend its operations (see In Focus). Also in Chile, lithium producer SQM had to temporarily suspend its operations in the world’s largest lithium deposit at the start of the year, due to road blockades by indigenous people. These conflicts show that environmental responsibility and the ’social license to operate’ are closely related. Such conflicts underscore the importance of obtaining a ‘social licence to operate’.

In focus: social challenges of expanding mining |

|---|

| Developments in Panama at the end of 2023 highlight the challenges for expanding mining and greening the energy supply amid rising anti-mining sentiment. In October 2023, Panama’s National Assembly approved a renegotiated contract with a subsidiary of Canada‑based First Quantum Minerals (FQM), the owner of Cobre Panama copper mine. The Cobre Panama mine started commercial operations in September 2019 and supplies 1.5% of the world’s copper. The new contract offered more favourable terms to the government and would allow FQM to extract copper for at least 20 years and extend mining operations for another 20 hectares in a forested area of the Panamanian Caribbean. Its approval by the National Assembly triggered massive social protests and road blockades. Protesters among others warned about threats to water supplies and the environmental impact of open-pit activity, which would destruct key ecosystems that indigenous people depend on. They filed a case at the country’s Supreme Court, saying that the contract may violate the constitution because there was no public bidding process, no effective or prior public consultation, and no environmental impact assessment. Anti-mining demonstrations only stopped once the Supreme Court unanimously declared in an historic ruling at the end of November that the contract was unconstitutional as it violated 25 articles of Panama’s constitution, effectively overturning the agreement. Those include the right to live in a pollution-free environment, the obligation of the state to protect the health of minors and its commitment to promote the economic and political engagement of indigenous and rural communities. Termination of the contract and the closure of the mine has negative consequences for Panama’s government finances and economy. The government might face arbitration claims for as much as USD 10 billion, the amount that FQM claims to have invested in the mine and associated infrastructure, including a power plant, cross-country transmission lines, roads and a port. This would amount to over 10% of Panama’s 2023 GDP. What will happen next is unclear, but renegotiation of the contract and restarting operations at the mine seems very challenging as the Court’s ruling and anti-mining sentiment offer little scope for this. In early January 2024, about 500 people protested at the Cobre Panama mine to pressure authorities and the mining company to follow through on plans to close the site. FQM has indicated that it is seeking formal talks with the Panamanian government to proceed with the safe and orderly closure of the mine (Chile's SQM suspends operations at lithium salt flats due to blockades | Reuters). In any case, the episode not only shows the challenges for the green transition but has also damaged Panama’s business-friendly reputation. |

Building a social contract is key for expanding LACs mineral activities

In order to capitalise on its mining potential, the LAC region needs to adhere to high ESG standards and benefit local communities. Preventing, mitigating and restoring the adverse impacts of mining on the environment are key tasks for the sector. We see three types of initiatives could help in this regard.

First, the global mining industry itself has done important work for instance by institutes such as Towards Sustainable Mining (TSM) and the Initiative for Responsible Mining Assurance (IRMA) and the Copper Mark that developed mine certifications and standards and advise on how to make mining accessible to local communities and stakeholders.

- TSM has participating organisations in 13 countries, including Argentina, Brazil, Colombia, Guatemala, Mexico and Panama. IRMA has completed audits at more than a dozen sites in Africa, North America (Mexico) and South America (Argentina, Brazil and Chile).

- The Copper Mark is a framework to promote responsible practices across the copper, molybdenum, nickel and zinc value chains. Over 30 mining companies in twenty countries participate, including Brazil, Chile, Mexico and Peru and it has 38 partners across the metal value chain.

- Furthermore, the International Council of Mining and Metals (ICMM) unites 24 mining companies (and 42 associate members), including from Bolivia, Brazil, Chile and Peru (and Colombia, Ecuador and Mexico as associate members) and is dedicated to a safe, fair and sustainable mining and metals industry. In October 2021 and in line with the objectives of the Paris Agreement, the ICCM members pledged to achieve net-zero scope 1 and 2 greenhouse gas emissions by 2050 or earlier.

Second, initiatives by international organisations support resource-rich countries to conduct sustainable mining. The Climate-Smart Mining Initiative, launched jointly in 2019 by the World bank and IFC and the EU-Latin America Partnership on Raw Materials project. The latter promotes sustainable and responsible mining with the environment and the communities to achieve a fair, green and climate-neutral economy. Such ESG standards and setting ESG objectives are necessary, but not sufficient for sustainable mining. Adherence to ESG standards and reporting is uneven in the LAC region because it contains many different types of mining companies, ranging from large global companies to smaller local companies. Among these global companies, those from China are for instance not a member of the initiatives mentioned above. Meanwhile, ESG-reporting for many of the smaller local mining companies is more challenging. Moreover, most of the ESG-standards are industry led and do not necessarily focus on what the local community finds to be valuable.

And third, and most importantly, initiatives by the mining countries themselves are needed to mine sustainably. To build trust and obtain a ‘social licence to operate’, authorities should not only set clear regulations, but also ensure compliance with these regulations and ESG standards. Most importantly, they should engage with local communities by setting up a dialogue between stakeholders, investors and communities. Particularly here the LAC mining countries have work to do. Chile is a good example of the importance of this. Its 2050 National Mining Policy is probably the most far reaching in the region. It includes targets to reduce water use in the mining industry, eliminate critical tailings by 2030, ensure that 90% of electrical energy contracts in the mining sector come from renewable sources by 2030 and 100% by 2050 and generate a positive net impact on biodiversity by 2050 in all large- and medium-scale mining projects developed since 2021. However, it does not explicitly contain measures to engage the local community. The feeling of being sidelined when state-run copper firm Codelco signed an agreement with lithium producer SQM was an important trigger for the road blockades that resulted in the suspension of SQM’s operations early 2024. This underlines the importance of engaging local communities at the beginning of mining projects.

Greetje Frankena, Deputy Head ERD

+31 20 553 2406

Dana Bodnar, Economist

+31 20 553 3165