Growing signs of cash flow strain amid grim insolvency outlook

Taiwan’s business landscape remains cautiously stable, yet signs of financial strain are becoming more visible.

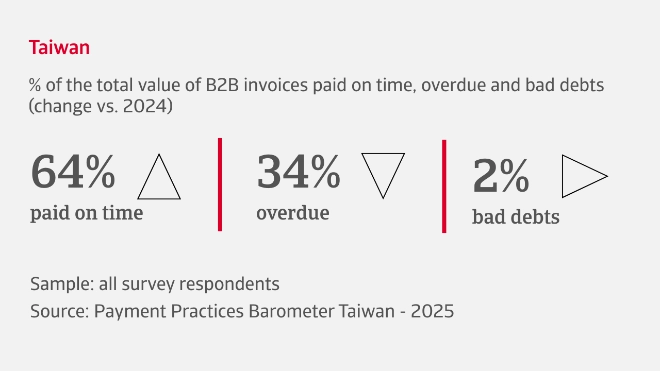

47% of companies in our survey report no major shift in B2B customer payment behaviour, but among the rest nearly as many report a deterioration, which points to a concerning trend in cash flow pressure. Overdue invoices currently affect an average 34% of all B2B sales on credit, the delays largely driven by cash flow issues. Bad debts remain relatively low, affecting just 2% of B2B invoices.

A striking 80% of companies in Taiwan’s highly trade-dependent economy have relaxed their trade credit policies in recent months. Payment terms remain steady for most, averaging 41 days from invoicing, though many companies are leaning toward extending terms rather than tightening them. 51% of B2B sales are currently made on credit, highlighting the key role of deferred payment in maintaining competitiveness and customer loyalty. Our survey highlights that businesses are carefully monitoring cash flow while being adaptive in how they manage liquidity needed to run day-to-day operations.

Days Sales Outstanding (DSO) is steady for nearly 60% of businesses, but a significant number report slower collection, suggesting growing strain on cash flow. Inventory turnover shows a mixed picture, with companies split between steady movement and stock build-up, which can further tie up liquidity. Days Payable Outstanding (DPO) remains unchanged for most, but among those reporting changes the majority delay supplier payments to preserve cash.

What are the concerns for Taiwanese businesses in the coming months?

Insolvency outlook grim as majority of businesses brace for challenges

Our survey finds that companies in Taiwan are bracing for a challenging financial period ahead as concern about a rising trend in B2B customer insolvencies weighs heavily on business confidence. 66% of firms expect insolvencies to surge in the coming months, more than double the number of companies that anticipate no change. This signals deep unease about the near-term economic outlook, especially as uncertainty about global trade and U.S. tariff policies continue to cloud business planning.

These worries extend into working capital management as companies look toward the second half of the year and beyond. Nearly two-thirds of businesses expect Days Sales Outstanding (DSO) to worsen, and this anticipated slower collection from customers is likely to restrict the inflow of operating cash. A similar concern surrounds inventory, with 50% of companies expecting inventory levels to build up, which could further tie up liquidity that might otherwise be used to respond to shifting market needs.

Expectations of rising B2B customer insolvencies in the coming months highlight the uncertainty businesses in Taiwan are facing.

Industry insights

Chemicals

35% of B2B sales in the chemicals industry are transacted on credit, reflecting not only a preference for upfront payments but also reduced trade volumes in recent months. Some segments report a more lenient credit stance, underscoring a mixed and fragmented landscape. Payment terms are longer for most businesses, now averaging around 30 days from invoicing. Overdue payments currently affect 31% of B2B invoices, primarily driven by customer liquidity constraints. Despite this, bad debts remain minimal. Most businesses report no significant shift in DSO, indicating stable but slow collection patterns that limit the ability to unlock working capital from receivables.

Electronics and ICT

The electronics and ICT sector operates in a climate of cautious confidence, with 59% of B2B transactions currently conducted on credit. This reflects increased trade flows in recent months and a growing preference among customers for deferred payments. While most suppliers have held invoice payment terms steady, a notable share of companies offer more relaxed conditions, averaging nearly 50 days from invoicing. Overdue payments affect 37% of B2B invoices, with many customers taking an extra month to settle past-due bills, mainly due to liquidity constraints. Bad debts currently average 4% of all B2B sales on credit.

Machinery

57% of B2B transactions in the machinery industry are currently made on credit, reflecting sustained trade flows accompanied by a widespread use of supplier credit. While most B2B payment terms are unchanged, some companies offer more relaxed conditions, with average terms now approaching 42 days from invoicing. Overdue invoices currently average 35% of all B2B sales on credit, with business customers typically taking an additional month to settle past-due payments. These delays are largely attributed to customer liquidity issues. Despite this, bad debts remain minimal, probably due to careful credit screening and proactive risk management.

Interested in finding out more?

For a complete overview of the 2025 survey results for Taiwan, download the full report from the related documents section below.

To explore how these insights can strengthen your own credit risk strategy, get in touch with us and see how we can help you stay ahead.

- 66% of businesses in Taiwan expect a surge in insolvencies—twice as many as those expecting no change — highlighting growing concern over the near-term economic outlook

- Concerns over working capital and an uncertain profitability outlook are fuelling a cautious stance for the second half of the year

- Amid growing signs of financial strain among businesses in Taiwan, resilience depends on strategic credit management

- Over 80% of firms use both internal reserves and outsourced risk management to manage B2B customers payment risk

Αίτηση επανάκλησης

Πώς μπορούμε να υποστηρίξουμε τη διαχείριση των κινδύνων σας;

Νομική ειδοποίηση